What is PMI Certification Portfolio Management Professional (PfMP) exam?

On May 25th, 2021, we have released Real Portfolio Management Professional PfMP Dumps Questions for all candidates. 495 practice exam questions and answers have been collected in a pdf file to help you prepare for Portfolio Management Professional (PfMP) certification exam. All the PfMP exam questions and answers are based on the Portfolio Management Professional (PfMP) exam topics and exam contents. We ensure that you can pass Portfolio Management Professional (PfMP) PfMP exam in the first attempt. Before getting PMI certification PfMP dumps questions, you need to know what is Portfolio Management Professional (PfMP) exam.

What is PMI Certification Portfolio Management Professional (PfMP) exam?

Portfolio Management Professional (PfMP) is one of hot PMI certification. The Project Management Institute (PMI) is a nonprofit membership association and certification body. The PMI Certification Program began in the early 1980s with the PMP credential, and PMI has since added several other certifications. Currently, there are 8 main certifications online:

● PMP® Project Management Professional

● CAPM® Certified Associate in Project Management

● PMI-PBA® Professional in Business Analysis

● PgMP® Program Management Professional

● PfMP® Portfolio Management Professional

● PMI-RMP® PMI Risk Management Professional

● PMI-SP® PMI Scheduling Professional

● PMI Project Management Ready™

PMI certification is best known for its Project Management Professional (PMP) credential and the Project Management Body of Knowledge (PMBOK), a collection of best practices and standards for project management. Its entry-level certification is the Certified Associate in Project Management (CAPM). Others are the upper-level certifications that focus on program management, portfolio management, agile practices, risk management, business analysis and scheduling.

PfMP Portfolio Management Professional certification exam recognizes the advanced experience and skill of portfolio managers. The PfMP demonstrates your proven ability in the coordinated management of one or more portfolios to achieve organizational objectives.

Why choosing to complete Portfolio Management Professional (PfMP) exam?

Most candidates, for example, an executive or senior-level practitioner managing a portfolio of projects and programs aligned with organizational strategy and focused on doing the right work, are highly recommended to complete Portfolio Management Professional (PfMP) certification exam. PfMP credential holders can be confident that their professional credential has been developed according to the best practices of test development and based upon input from the practitioners who establish those standards.

What are the real PfMP dumps questions based on?

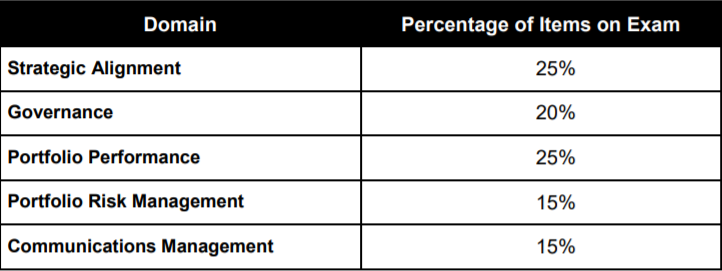

Real Portfolio Management Professional PfMP Dumps Questions have been released. The PMI certification PfMP exam dumps are great to ensure that you can pass Portfolio Management Professional (PfMP) exam in the first attempt. The real PfMP dumps questions are based on the Portfolio Management Professional (PfMP) exam outline:

The great team spent a lot time and energy to complete the real PfMP exam dumps questions, covering all the exam outlines. You can read PMI PfMP free dumps as below first:

Assume you are the portfolio manager for your pork producing company, the market leader in your country. Over time, the industry has recovered from trichinosis as a risk. Your company has added new components to its portfolio, and many have been to demonstrate to the public that its products are safe. It implemented the Agriculture Department's and Food and Drug Administration's Hazard Analysis and Critical Control Point (HACCP) regulations and is enhancing its image as 'the other white meat'. However, now the entire industry is faced with a new epidemic known as porcine epidemic virus, which is affecting pigs in 22 different states, and profits have decreased significantly. New components now must be added to the portfolio.

This situation shows:

A. Resource re-allocation is required

B. Risk management is essential

C. The ROI of the new components must be determined

D. Portfolio rebalancing has led to the new components being in the top five priority list

Answer: B

Managing risk is key to the success of any initiative. Risk is considered to be inherent in any activity we do in project management and at any level. Risk is part of project, program and portfolio management and has a different exposure in each and every one.

Which of the following highlights this difference?

A. Project and Programs risks are combined in order to develop the portfolio risk register as an aggregation of both

B. Risks at project and programs level can be eliminated, but not at portfolio level

C. Portfolio risks are inter-components risks, while program and project risks are not

D. Project and Program risks are risks within the boundaries of the project or program, while portfolio risks can span the organizational level

Answer: D

As part of the portfolio communication management, multiple documents are prepared in order to effectively manage communications.

The Stakeholder matrix is one of the prepared documents, what does it include?

A. Stakeholders quadrants showing the level of interest and influence

B. Stakeholders roles, interests, expectations and groups

C. Intended recipients, communication vehicles, frequency and communication areas

D. Representation of all of the communication for the portfolio and their frequency over a period of time

Answer: B

In order to guide the work and correctly manage the portfolio, one of the major documents to be prepared is the Portfolio Management Plan acting as guideline for portfolio management.

What are the tools and techniques you could use while developing this plan?

A. Integration of Subsidiary Plans, Organizational Structure Analysis, Elicitation techniques

B. Capability & Capacity Analysis, Weighted Ranking and scoring techniques, Graphical Analytical Methods, Quantitative & Qualitative Analysis, PMIS

C. Capability & Capacity Analysis, Weighted Ranking and scoring techniques, Graphical Analytical Methods, Quantitative & Qualitative Analysis

D. Weighted Ranking and scoring techniques, Portfolio Component inventory, Categorization

Answer: A

Your company got recently acquired by another company and the strategic directions which your portfolio is based on have been changed.

Which document do you, as a portfolio manager, update to reflect the change to the timeline?

A. Communication Management Plan

B. Portfolio Management Plan

C. Portfolio Strategic Plan

D. Portfolio Roadmap

Answer: A

Because your company's Portfolio Review Board consists of the Directors of its five business units and is chaired by the CEO, the meetings tend to be contentious as there is limited funding available to authorize all the proposed programs and projects. Dissension also is the norm if resources are reallocated from one business unit to another.

As a result, the CEO:

A. Strives to use consensus to make decisions, but this approach rarely is effective

B. Decided to use an outside facilitator when meetings are held

C. Uses multi-voting and makes the final decision

D. Often uses a Delphi approach

Answer: B

In your portfolio some of the programs and projects that are being pursued will realize benefits throughout the program and project's life cycle, while others will not realize the benefits until the program or project is closed or years later.

This means as the portfolio manager, you should:

A. Prepare a portfolio benefit realization plan

B. Set up KPIs to document progress in benefit realization

C. Include portfolio benefits, results, and expected value in the portfolio strategic plan

D. Distribute regular reports on benefit realization as part of the portfolio communications management strategy

Answer: C

You are the portfolio management for a big corporate with existence in 3 continents.

While planning the performance management and in particular the dashboards and reporting tools, which of the following options is the most important to account for the different geographical locations?

A. Organizational Process Assets

B. Portfolio Process Assets

C. Enterprise Environmental Factors (EEFs)

D. A good sponsor to back you up

Answer: C

You are managing a complex portfolio with high risk levels due to emerging technological breakthroughs and a short benefit window to market your product. You know that managing risks is key to success, and you are coaching your team on the same. While planning for risk management, multiple investment choice tools are used as part of the quantitative and qualitative analyzes.

Which of the following tools determines the effects of portfolio velocity?

A. Budget Variability

B. Market Payoff variability

C. Time-To-Market Variability

D. Trade-Off Analysis

Answer: C

You are managing a portfolio in a functional organization and resources are shared between operations and projects. You are continuously performing capability and capacity analysis in order to optimize the portfolio.

Which of the following capability and capacity analysis is used to limit the number OR size of components the organization can execute?

A. Knowledge Basis

B. Financial

C. Human Resources

D. Assets

Answer: B

A portfolio manager needs to continuously balance the need and requirements with the available resources to maintain a balanced portfolio and portfolio resources in order to optimize delivery, in addition to managing communication, risk, etc. For this you develop a robust Portfolio Management Plan.

Which of the below is not a part of this plan?

A. Change Control and Management

B. Portfolio Communication Management Plan

C. Portfolio Strategic Plan

D. Portfolio Performance Management Plan

Answer: C

Over the years, your organization has grown significantly as it has entered new markets while maintaining its presence in its traditional product line of security systems. The company now has eight different business units rather than three, which was the case only two years ago, and it set up funding originally such that it was only allocated to one business unit and could not be transferred to others. At the recently held Portfolio Oversight Committee meeting, five business units did not add components, but some were completed. The other three added a number of programs and projects, which were authorized. Now funding for these new components is an issue.

This means:

A. Another Committee meeting is required to focus on the funding problem

B. The sponsors of the newly authorized components need to work with their business units to determine how funds will be allocated

C. The three business units need to evaluate their portfolios and recommend termination of some components to the Committee

D. Changes are required as to how funds are allocated

Answer: D

As you are the portfolio manager for your state government agency, which is undergoing a series of budget cuts, you are focusing attention on managing risks to the portfolio as the budget is reduced. You realize in this process the time and budget for risk management also will be reduced; these data are in the:

A. Portfolio performance plan

B. Portfolio strategic plan

C. Portfolio management plan

D. Portfolio financial plan

Answer: C

Working as the portfolio manager for your business unit of a major aerospace organization means you have a variety of programs, projects, and operational activities under way.

You have set up a number of reports on the progress of the portfolio for your various stakeholders, but the best approach is to monitor the progress of the portfolio against:

A. Organizational strategy

B. Organizational goals

C. Specific key performance indicators for the business unit

D. Organizational critical success factors

Answer: A

A problem related to internal corruption has occurred in your company. The CEO has setup a new management team and had to do budget cuts until the situation is stabilized. Your portfolio is highly affected by this budget cut and you were obliged to cancel a few components.

What is your best course of action in this case?

A. Cancel the components that are not performing well

B. Do not cancel components; and request additional budget from the management

C. Prioritize components and assign the available resources to them

D. Raise the issue to the sponsor so he can get you additional resources

Answer: C

As part of the Portfolio Communication, the Portfolio Manager analyzes the raw data assimilated from the portfolio process assets and from the stakeholder analysis. This analysis aims to isolate the data that hold value to the receiving audience.

Which tool can the portfolio manager use to help him in performing this analysis?

A. Communication Methods

B. Elicitation

C. Stakeholder Analysis

D. Communication Requirements Analysis

Answer: D

Assume your automotive company is new to formal portfolio management. It has had for years a strategic plan and tries to be first to market for new and improved features on its vehicles each model year. You were hired as the portfolio manager to provide a more disciplined approach for determining new products to pursue as well as existing ones that should be terminated. So far, you have set up an approach, established categories for the various components, and determined a method to rank and score new proposals for consideration. Now you are working to set up practices to follow to optimize the portfolio. In doing so, it is important to note that:

A. The criteria to optimize the portfolio may be the same as that used in the scoring model

B. A portfolio management information system should be set up

C. Future investment requirements are a key criterion to consider

D. Compliance with organizational standards cannot be overlooked

Answer: A

You are the portfolio manager in a large organization including a diversity of stakeholders.

From the start, you knew the importance of correctly managing the stakeholders requirements and concerns and you grouped them in order to

A. Group stakeholders as internal and external

B. Facilitate stakeholders identification

C. Group stakeholders from the same functional area

D. Group stakeholders having same concerns and interests

Answer: B

Establishing a portfolio management process starts with the development of the organizational portfolio management implementation plan.

Which of the following helps while developing this plan?

A. A proficient management team commitment to the effort

B. All of the options

C. A planned approach to change organizational behavior that includes a balance of strong leadership and management

D. A planned approach for incrementally developing and implementing portfolio management processes

Answer: B

One of your component managers has submitted his resignation and left the company; a new program manager joins the portfolio replacing him.

Which document you use to inform the new program manager about his responsibilities in the portfolio?

A. Program Business Case

B. Portfolio Roadmap

C. Portfolio Management Plan

D. Portfolio Charter

Answer: C